The Importance of Investing (Compound Interest)

I am not a financial advisor, this is not advice. This post is just for fun, I’m just a weird dude who enjoys talking about finances. For further advice, please seek a professional financial advisor. Don’t sue me. Also, to break up the investing talk, I’ve added some pictures of bee butts. Enjoy

Investing in the stock market is a crucial way to amass wealth over your lifetime. Luckily in Australia, you’re forced to have some exposure to the market with superannuation. I believe if you’re in the fortunate position to have some spare money around, it is a great thing to do as early on as possible. Consistent investing is ideal as compound interest plays such a huge role in creating wealth. Let’s take a look at the numbers, the average returns over the last 100 years has been 10% pa. For these examples, I’ll show you some numbers that I spun up using the low end of 7% pa to be conservative. I should note at that I only invest in ETFs (exchange traded funds - basically groups of stocks) as I prefer a “safe” investment with the goal of long term returns.

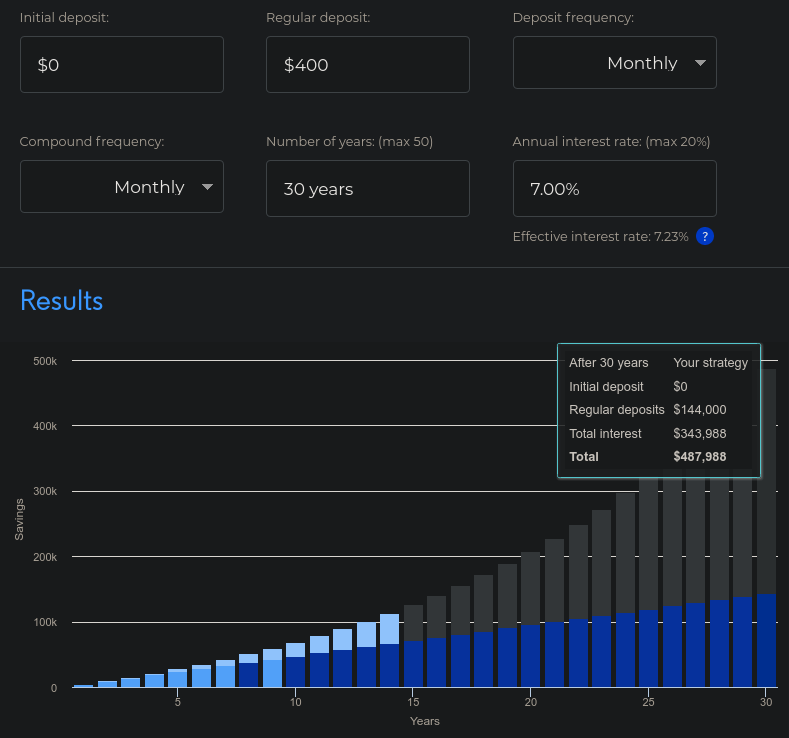

Let’s say you’re fortunate enough to have a spare $100 a week. If you find yourself at a decent income but can’t seem to save, you might want to check if you’re falling into the trap of a lot of Microspending. In this example, if you invest that amount for 30 years at 7% per year, you end up with just under $500,000 which would be a great safety net to go along with your super when you retire.

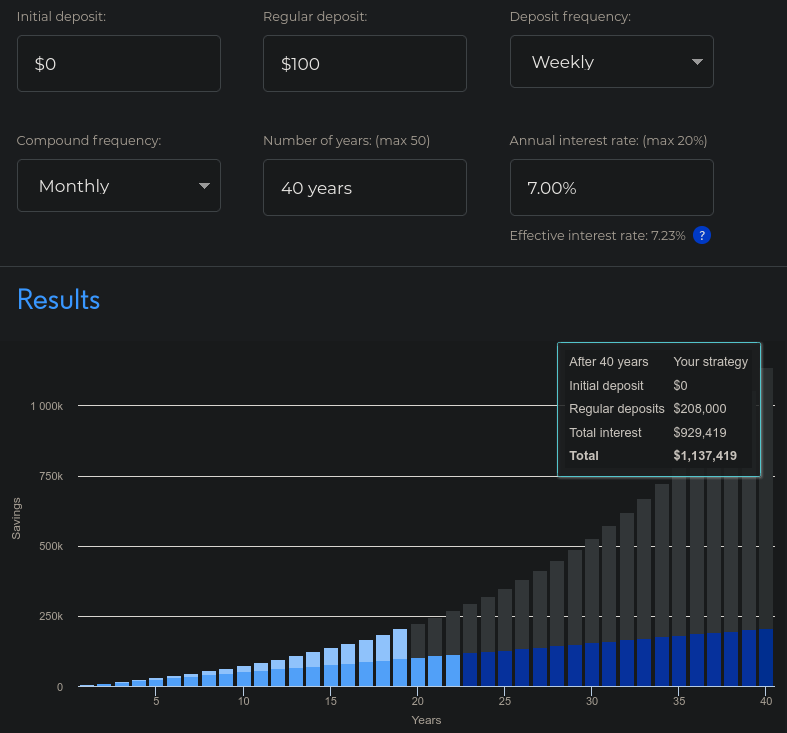

If you begin a bit younger, have a bit more time on your hands (40 years) till you decide to retire and put the same amount of money per week into the market at a 7% return. You end up with just over $1,100,000 as a nest egg to go with super, effectively doubling your returns.

Go ahead and play around with the compound interest calculator here, it’ll show you just how powerful investing over the long term is and the difference between starting now and in 10 years is a huge amount of money. Unfortunately only 37% of people between the ages 18-35 are investing in the stock market, of course many of those people may not be in a financial position where investing isn’t an option. However, I do believe there is a large portion of people that just aren’t aware of it, or put it off as something they’ll do in the future.

Source: Pinterest so it was probably stolen from somewhere.

Where do you start?

Before you begin throwing your money at the market, there are a few things that you should probably consider. These are the boring things that need to be addressed before using your money elsewhere.

Addressing any debt

If you have any outstanding bad debt (anything over 5% interest pa) like car loans, personal loans or credit cards should be paid off before investing if it makes sense to do so. If you have several thousand dollars in credit card debt at 24% interest, every dollar you pay off you are making 24% interest on that.

Safety Net

Before investing any money into the market, it’s super important to have a lump sum of cash that is available immediately as a “break glass if emergency” box. This is a must have for peace of mind. The idea behind the safety net is, if something was to come up like car issues or you lose your job that you could then support yourself without selling your investments. The amount of money needed is completely up to you, the general consensus is at least 3 months worth of pay, however some prefer more. I personally store 6 months worth of expenses.

What Platform?

Alright, so you’ve paid off all your high interest debt and have build a nice little safety net that you can rely on in case anything bad happens and you need money fast. Now you have to chose a platform, there are quite a few out there with different advantages/disadvantages. The two main types are your standard broker and micro investing platforms. The standard broker is tailored to higher amounts of money per purchase so they have a higher flat fee. Whereas the micro investing platforms are tailored to smaller amounts of money per purchase due to their lower flat rate fees.

For micro investing I recommend Spaceship as they don’t charge fees until the balance reaches $5k, however, I go through the positives and negatives of a few platforms in this blog.

For your standard brokerage, I recommend SelfWealth as they have the cheapest fees compared to other brokerages at $9.50 a trade.

What do I buy?

If you’re micro investing on one of those platforms mentioned above, they’re quite limited on what you’re able to buy. If you’re using a standard broker, I would recommend investigating a few separate ETFs as they all cover separate markets. I personally prefer VGS and VAS and opt for an 80%/20% split so I don’t have too much exposure to Australian markets as I work here.

However, this is where this blog leaves you to do your own research as I can’t decide or tell you what is best for you as I’m not a financial advisor.