Micro Investing

I am not a financial advisor, this is not advice. This post is just for fun, I’m just a weird dude who enjoys talking about finances. For further advice, please seek a professional financial advisor. Don’t sue me.

Investing in shares is commonly only viewed as something for the rich, those with large amounts of money to spare. However, that is no longer the case, micro investing is taking large scale investing and bringing it down to a smaller scale, one that anyone can begin to use and get involved with. Anyone is able to get set up and begin depositing small amounts of money as they have it spare and benefit from having money in the market.

Why micro invest?

Investing is a great way for individuals to build wealth, commonly beating banks interest rates by a long shot, and a great way to build a retirement portfolio. Normal investing practices with shares involve investing large amounts at a time to minimise brokerage fees. Micro investing allows individuals to invest small amounts at a time with minimal or no brokerage fee making it easier for the average individual to begin building out a portfolio with very little effort. If something takes minimal effort, more people are more likely to do it and do it more consistently, leading to larger returns in the long run due to the beauty of compound interest.

Now, at this point you might be thinking “I don’t know who I am or what you’re talking about, but I read ‘huge gains, no effort’ and I like gains, will this work for me? I don’t know how stocks work other than the memes”.

I always follow the advice that you should have at least a basic understanding of where your money is invested, no matter what the investment is. However, I know many don’t want to understand how the stock market works, which is perfect for many micro investment platforms. Many platforms allow you to have very little understanding of how things work, you can basically set them up as a secondary bank account that you can transfer money into on occasion and that money will be invested accordingly.

How?

If you’ve made it this far into the article you might be thinking - “Alright 0ldMate, if that is your real name, you’ve got me interested, tell me how I can throw my life savings into this air quotes micro investing end air quotes”

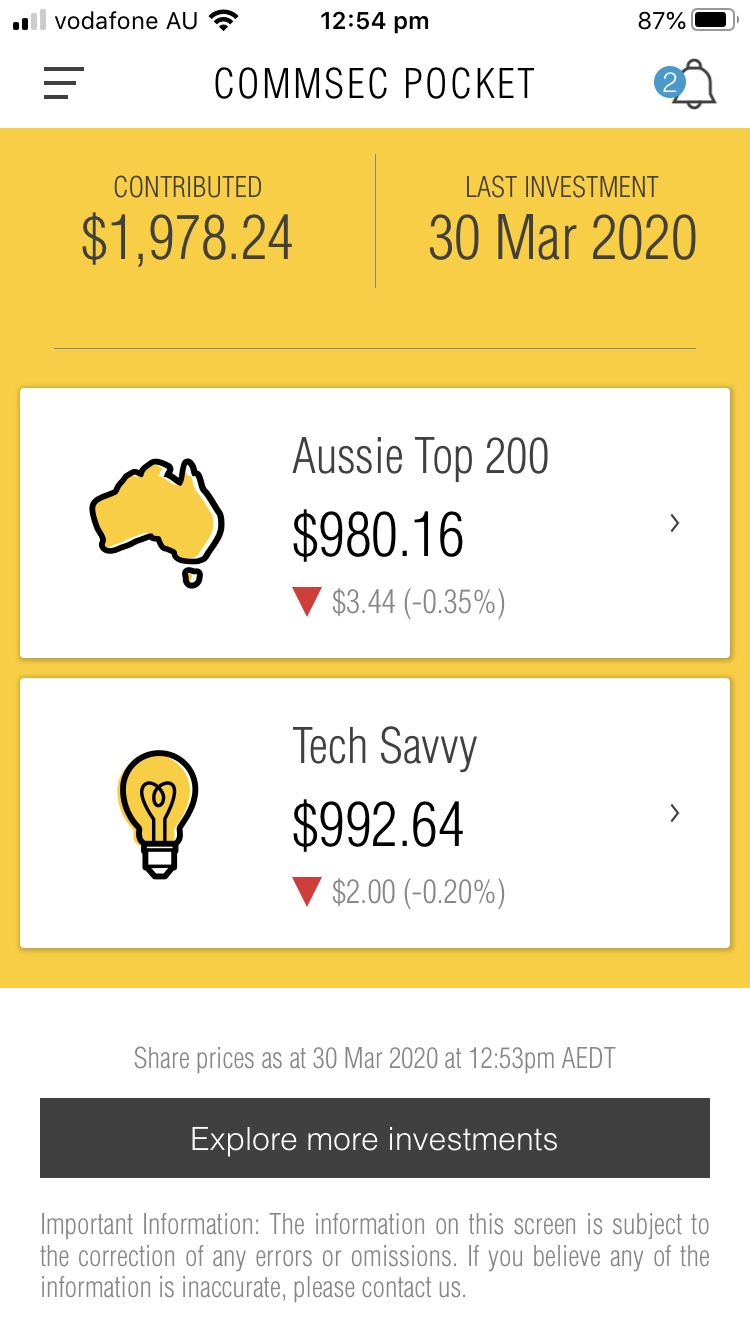

As mentioned above, there are many different companies and apps that are filling this space and more are constantly trying to get into the space. The 3 different platforms I recommend are Spaceship, Commsec Pocket and Raiz. You can sign up to any of these and begin building out an investment portfolio. Each platform has it’s own set of positives and negatives as follows:

SpaceShip:

Pros:

- Easy set up

- Simple portfolios

- No fees under $5,000

Cons:

- Limited portfolios

Link: https://www.spaceship.com.au/

Referral (You get $5, I get $5): https://spaceship.app.link/refer?code=S8K3GVPW9Z

*See bottom of article

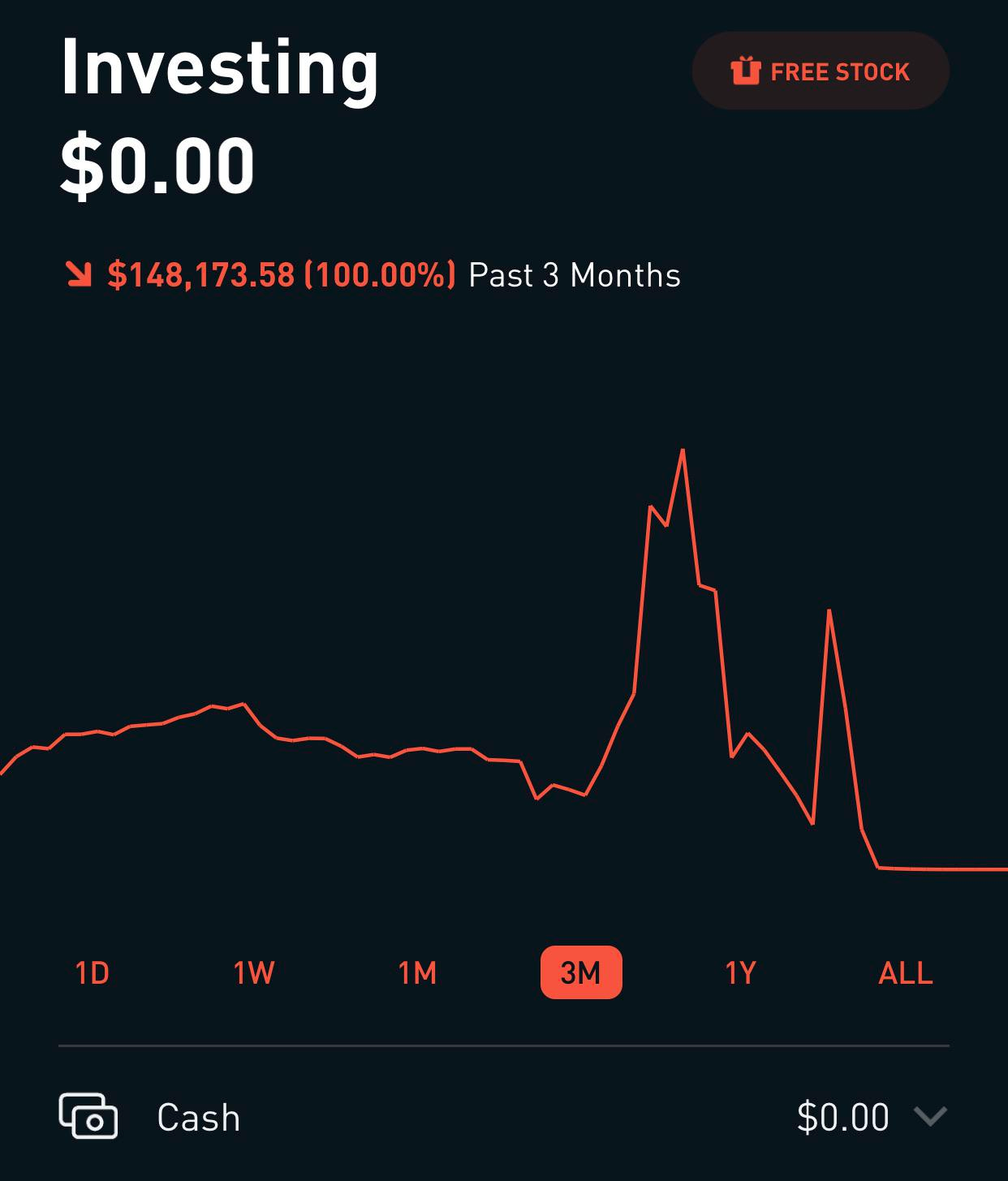

CommSec Pocket:

Pros:

- Easy set up if CommonWealth Bank customer

- Links to CommSec account

- Larger variety of investment portfolios

- $2 trades if under $1000

Cons:

- Need to be a CommonWealth Bank customer

Link: https://www.commsec.com.au/pocket

Raiz:

Pros:

- Round up feature

- Various levels of risk portfolios

- Invest when you shop

Cons:

- Monthly fee

Link: https://raizinvest.com.au/

Referral (You get $5, I get $5): https://app.raizinvest.com.au/invite/APCDW7

*See bottom of article

Conclusion

At the time of writing this blog I recommend Spaceship or CommSec Pocket to those who are interested in microinvesting. Spaceship for those who are after a simple set up and are new to investing. CommSec Pocket to those who are with CommonWealth Bank already and want a bit more variety in their stock purchases. It’s best to check out all options available to you and see which one is best for you. I will have a future blog out shortly that goes a little bit more detail into Spaceship vs Raiz and the differences I’ve found whilst using them both throughout all of last year, along with my returns on each.

I hope this post has got you at least interested in investing in some way, there’s a lot of information out there to learn more and hopefully my future blogs will help as well.

*Referral links

So, I wasn’t sure if I should include referral links in these since often in the finance scene it’s always a bit sketchy as people often only push products they can benefit off by referrals. I want to stress that I don’t care if you use my referral link, hence why it’s below the non-referral link, it benefits me and you but it’s not the reason I wrote this blog. I love talking about this stuff it’s super fascinating (ask any close friend, I’m banned from talking about it at events) and I feel like many people, especially younger people don’t understand it which is disappointing because knowing about finances and investing can change their lives. That’s the reason why I started these finance posts, to get people interested in finances early.