Microspending

I am not a financial advisor, this is not advice. This post is just for fun, I’m just a weird dude who enjoys talking about finances. For further advice, please seek a professional financial advisor. Don’t sue me.

Microspending is a relatively new term that is used to describe the small expenses or purchases that commonly come up or occur. These purchases which are normally under around $20, due to this they’re normally written off as nothing, however, they can add up drastically over time if they’re not tracked or reviewed regularly. These purchases can fall into a lot of categories, however, here are a few examples I’ve noticed:

- Food and drink

- Parking

- Microtransactions

- Subscriptions

These purchases can be super common and minor enough that you don’t think twice about them. To demonstrate the problem with that, I’ve written up a pretty reasonable scenario.

Bob’s Weekly Adventure

Bob drives into work every day for work, he knows that if he parks in a side street that is a 10 minute walk away from work he can park for free. Although he’s known this for years now, he is in the habit of parking out the front of his workplace which costs him $5 a day and skips his daily walk because he hates the sun. Bob’s work place offers decent coffee for free, but he loves the cafe that’s on the bottom level of the building so he always grabs a coffee every day. He gets his regular coffee which is $5, however on every other day (Tuesday and Thursday) the cafe has a deal to get a muffin and a coffee for $8 which always gets because muffins are fantastic and he can have that for lunch. On the other days (Monday, Wednesday and Friday), he grabs something light for lunch for $10. On weekends, Bob typically gets a coffee from a cafe near him for $5 each day, eats lunch at home but grabs dinner out both nights for $20 each night. Overall, all of these purchases seem worth it at the time and as they’re such small amounts, Bob pays without even thinking about it.

Analysis - TL;DR

So, every week Bob spends:

- $25 on parking

- $35 on coffee

- $6 on muffins

- $30 on lunch

- $40 on dinner

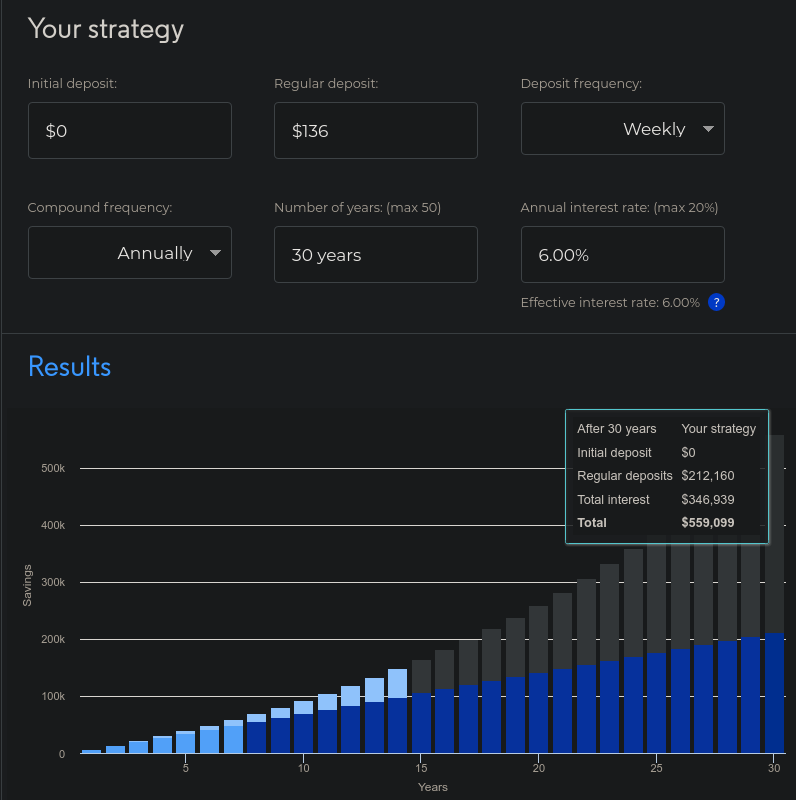

That works out to $136 per week or $7,072 per year in microspending. That already is a huge number, but if we take that one step further and say over the next 30 years Bob takes the money he’d normally spend on these small purchases and invests it into an ETF (exchange traded fund) at a conservative 6% per year, he would end up with just under $600,000 ($599,099) as a nice retirement nest egg.

Source: https://moneysmart.gov.au/budgeting/compound-interest-calculator

What to do about them?

Alright so now you know microspending is bad and easy to lose track of it, what can you do to reduce the frequency you do it?

- Track your spendings - When you’ve got this magic flashy card that beeps and you receive things it’s very easy to spend without acknowledging it. I’d recommend tracking your spending, at the end of the month/quarter take a look at what you’ve spent and where you’ve spent it, the occasional $5 coffee might seem like nothing at the time, but every day over a month will add up and seeing that figure might be a shock.

- Conciously spend - After you’ve seen how much you’ve spent this month, you should try to be concious about how often you spend on those small things. I find that if the purchase is over $50 I’ll really think about if i really need it, within reason I try to apply that same logic to the smaller purchases. That seems to help me, anyways.

How do I track my microspendings?

Currently I track my purchases using Elastic Cash, which works relatively well, however I’m sure there’s something better out there for it, but I’ve not found it yet. One of the easy and super affective ways is to export a transaction spreadsheet from your bank and visualise it all in excel.

What is the point of this post?

I wrote this to hopefully enforce the idea of how easy it is to over look small purchases, and when they’re frequent, it adds up quite drastically. If you’re trying to save more money, it’s a lot easier to reduce your spending than it is to earn more money. The intent of the post wasn’t to make you cut out all small purchase but to be more aware of the easy spending habits most people have developed and perhaps cut back on some of them to save further. I hope this has made you think twice before swiping your weird plastic card to get that sweet bean juice everyday.