Credit Card Churning

I am not a financial advisor, this is not advice. This post is just for fun, I’m just a weird dude who enjoys talking about finances. For further advice, please seek a professional financial advisor. Don’t sue me.

Credit cards are awesome if you use them correctly. I think when most people think of credit cards, they think of the horror stories, the people who get a credit card with the maximum limit and spend it all on a holiday or shopping. I want to make it clear that the way I use credit cards revolves entirely around not spending a cent on interest. If you get charged any interest on a credit card you’re doing it wrong. If you use them correctly you can easily make a few extra thousand dollars a year in points for very minimal work. These points can be used for flights, flight upgrades and gift cards. This blog post will detail some of the things you need to know before you start “credit card churning”.

To break up the wall of text, here are some photos of where you could go with the points you’ll be racking up. Below includes the details of the flight + costs (all flights are one way) according to the Qantas website.

Source: https://www.britannica.com/place/Melbourne

Sydney to Melbourne: 8,000 points + $36.80 taxes and fees

What is “credit card churning”?

Credit card churning is the method of opening up a credit card that provides some kind of bonus rewards on sign up (ie Qantas points, cash back or rewards points), achieving the minimum requirements to gain that sign up bonus and then closing the card shortly after. This allows you to get multiple sign up bonuses a year, as you can only have so much credit open at a time depending on your income and other debt (if you have any).

Source: https://www.travelandleisure.com/travel-guide/sydney

Perth to Sydney: 18,000 points + $41.72 taxes and fees

Don’t sign up bonuses have “time out” periods?

Every credit card with a sign up bonus has a time out period between applying for another of the same card, ie you can’t get 2 American Express Qantas cards and get sign up bonuses on both within X period (typically 12-18 months). Churning allows you to close them early and begin the wait asap. Once you close one card, typically another bank will have another offer that is worth going through and after you’ve cycled through a few different cards, that time out period should be over.

Source: https://www.britannica.com/place/Hong-Kong

Brisbane to Hong Kong: 25,200 points + $135.40 taxes and fees

Why churn credit cards?

Churning can make you a few thousand dollars a year in points and rewards. If you travel often, being able to use points for flights and upgrades is a great way to travel for a very reduced price tag. If travel isn’t your thing, you can also swap these points for gift cards for stores. Each bank has their own “rewards” system with different names but for travellers the main two are Qantas and Velocity points. Additionally, certain credit cards will allow you to get access to lounges, travel vouchers, wine subscription discounts and more.

Every bank has different terms of service with their credit cards, most will allow you to get 1 credit card that is Qantas points and 1 credit card that is Velocity (Virgin) at the same time. Some banks will also allow for a 3rd card that is their rewards system or some kind of cashback card. Thus increasing the pool of credit cards you can churn whilst waiting out the “time out” period.

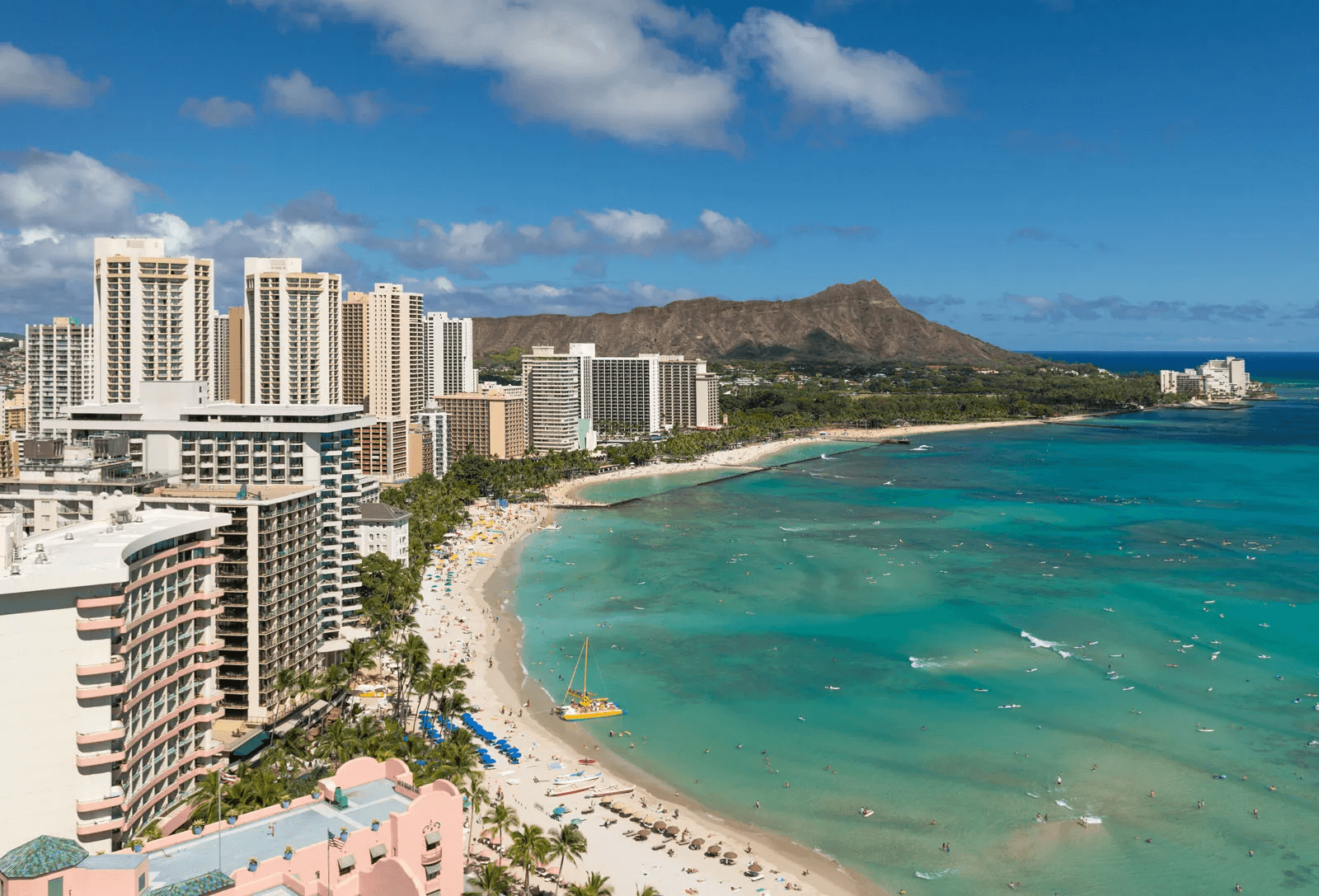

Source: https://www.britannica.com/place/Honolulu

Sydney to Honolulu: 31,500 points + $188.72 taxes and fees

Does this affect my credit score?

Credit scores as a system are still slowly being introduced here. Typically over in the US, having many open credit cards/more credit lines available for longer makes you appear more trustworthy and thus have a higher credit score. In Australia, it’s the opposite, the more credit available to you, the less they are willing to give you. I have not had any issues with credit scores when I’ve churned credit cards, There is a minor drop of around 3 points each time there’s a credit inquiry, but it then returns to normal. According to creditsavy, I have an above average credit score well into the green. I always pay my bills on time and have not missed a bill, if you started missing payments, that would definitely affect it. Note: opening up credit cards 6 months before getting loans may limit how much you are able to loan.

Source: https://www.britannica.com/place/Shanghai

Sydney to Shanghai: 31,500 points + $188.72 taxes and fees

Credit card approval process

The credit card approval process is super dependant on a few main things, previous credit, salary, outstanding debt, other income resources and I’m sure many other factors. You will never know why you were denied, but if it does happen, it is best to wait at least a few months before applying for another credit card. Every time you apply for a credit card, a credit check is done which goes on file.

Source: https://www.britannica.com/place/Auckland-New-Zealand

Melbourne to Auckland (business class): 41,500 points + $132.18 taxes and fees

Where do I find these credit cards?

My go too spots are OzBargain and PointHacks.

Source: https://www.britannica.com/place/Los-Angeles-California

Melbourne to Los Angeles: 41,900 points + $197.48 taxes and fees

Worth it?

So now you’re a few minutes into reading my silly post about credit cards, is it worth going through this? I think it is, but your mileage may vary. Using a few credit cards you can stack up points to fly internationally for just tax cost or fly multiple times interstate (flights are subject to select times/dates so they can be fiddly to get ideal flights). You can easily grab some gift vouchers and make some free cash that way. These credit card deals are made up to lure the vulnerable into over spending and owing interest. So why not take the banks for a ride and profit off this. Do note that this only works if you are responsible with spending and don’t go over board.

Credit cards can be scary but they can also be great, make sure you read up on the conditions of the credit cards before signing up.

Source: https://www.britannica.com/place/Singapore

Perth to Singapore (business class): 57,000 points + $244.45 taxes and fees

Note: Minimal spending

Most of these credit cards will have a minimal spend (ie 3,000 in 2 months) to get the sign up bonus. There’s no point churning to get $1000 in points if you overspend $2500 on stuff you don’t need. Time these with big expenses, buy gift cards or just put all of the household expenses on these credit cards. Don’t over spend to reach these minimum spends, if you do, what’s the point.

Source: https://www.britannica.com/place/London

Sydney to London: 55,200 points + $241.82 taxes and fees

Bonus: interest free loan

A range of credit cards have “balance transfers” available. These allow you to transfer money owing from another credit card to a new credit card and will give you an interest free period (normally 24/36 months). This is effectively a 0% loan for X amount of time. You can rack up 10k in credit cards, and then balance transfer it to another card and slowly pay it off over that time rather than the 45 day billing period.

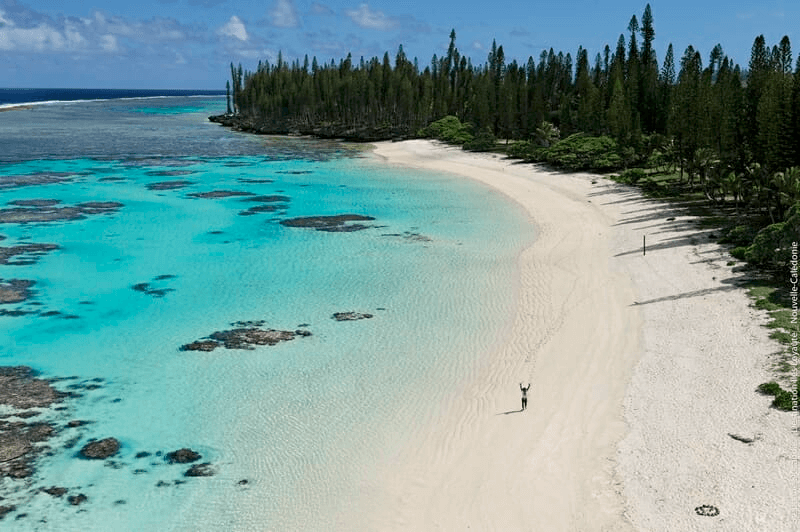

Source: https://www.mynewcaledonia.com.au/best-things-to-do-in-noumea-new-caledonia/

Sydney to Noumea: 18,000 points + $106.16 taxes and fees

Bonus 2 - Electric Boogaloo: Money safety + insurance

If you’ve ever had card details stolen, you know how much that sucks. If you use a debit card constantly and fraudulent purchases are made; sometimes it takes weeks or even months to get that back which can cause monetary stress. If you use a credit card and it gets stolen, that money isn’t yours. Once you report it to the bank, it’s up to them to get it back and you don’t lose a dime.

Additionally, most credit cards come with additional insurance such as travel insurance, phone screen insurance, purchase insurance and extended warranty. Make sure to check out what insurance is available on your cards and what it covers.